The Future of Banking is here and it's more personal, more intelligent, and more secure than ever. We're giving you a first look at the latest innovations and industry-first functions and enhancements that Discovery Bank is introducing, that will completely transform your banking experience and further empower you to take full control of your financial world.

The Future of Banking is more personal, intelligent, and secure

For an overview of the Future of Banking. Now., watch here

Boost your Vitality Money status with financial planning

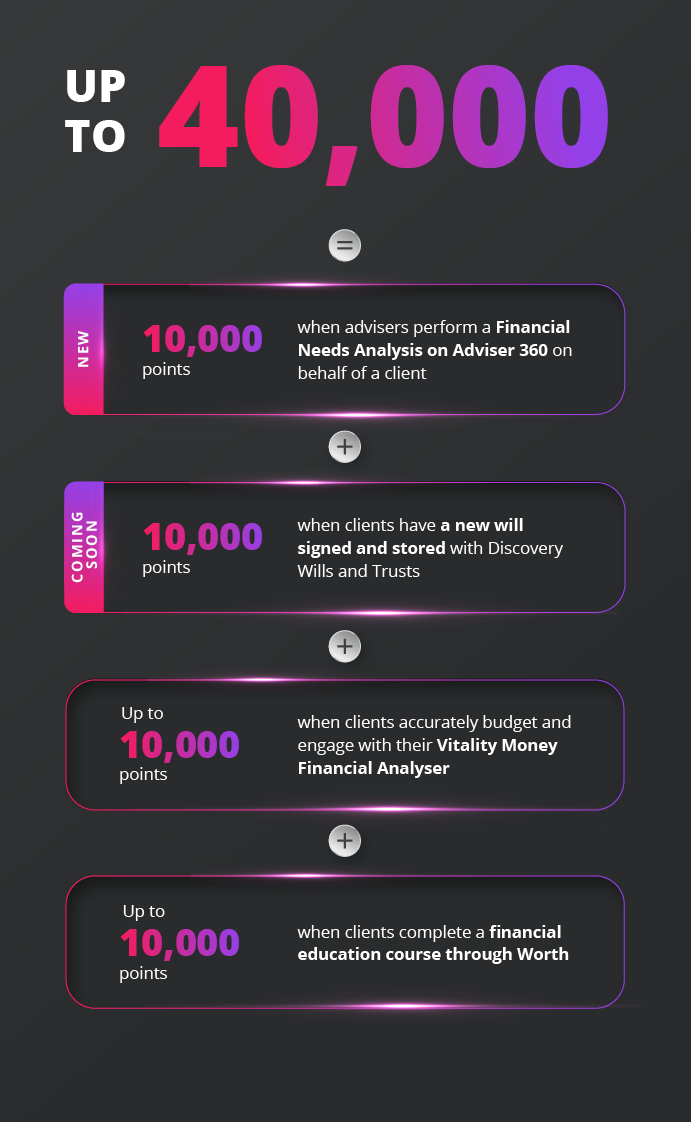

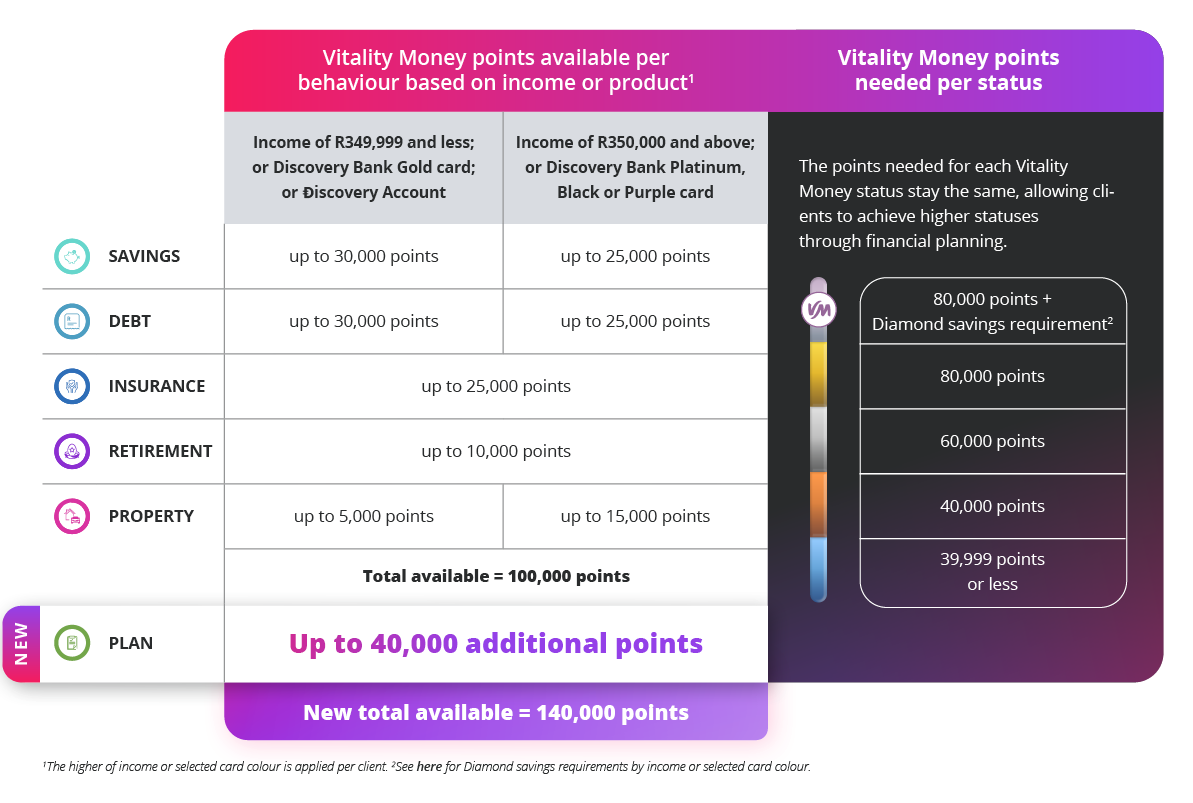

You can earn up to 100,000 Vitality Money points for healthy financial behaviours, which you can track through your Savings, Debt, Insurance, Retirement, and Property behaviour rings in your Discovery Bank app. Now we're introducing the Plan ring: the newest addition to Vitality Money, designed to help you track and improve your financial planning and earn up to 40,000 additional Vitality Money points in the process.

You can already earn up to 30,000 points for financial education, short-term budgeting and long-term financial planning, and soon you'll be able to earn 10,000 points for having a new will signed and stored with Discovery Wills and Trusts as well. These points give you more ways to achieve higher Vitality Money statuses and unlock even more rewards.

Making your banking experience even safer and more secure

We've reimagined protection for the digital era, as changing security risks need new safety tools. Discovery Bank's multi-layered approach to account security shifts focus from physical vaults and tellers to real-time client empowerment. In addition to advanced backend fraud monitoring systems, Discovery Bank equips you with powerful, easy-to-use tools designed to help stop fraud before it happens.

Key security features:

- Biometric authentication: Securely authenticate your identity with live selfie verification and biometric checks.

- Card and device management: Easily manage your cards and linked devices, set spending limits, and track transactions - ensuring that even if credentials are compromised, fraudsters can't gain access. Manage your cards and devices in the app, including creating virtual cards, setting spend limits, and suspending or deleting digital cards.

- Persistent fraud warnings: Receive real-time risk warnings and alerts to stay vigilant against potential fraud. These alerts that help you avoid social engineering scams include in-app pop-ups to warn when you open your app when you're on a call - a persistent in-app banner reminds clients that unverified calls require caution, creating a crucial 'think twice' moment.

- The digital account vault: Hide selected accounts behind an additional security layer for extra protection. Secure your most sensitive accounts with an additional layer of protection after setting up custom security and panic codes.

- Panic code: Use a unique panic code if you're forced to transact under duress. Enter it to silently alert Discovery Bank and trigger real-time fraud monitoring and safety protocols, coordinating with law enforcement, and where necessary dispatching armed response to your last known location.

Seamlessly manage your cards

The Discovery Bank app already makes it easy for you to create and manage your cards in just a few taps. Now, with our latest enhancements, you'll have even greater control over every card - along with the devices and services they're linked to.

Create and manage up to 50 free virtual cards, easily assign nicknames to each one for easier identification, and view transactions grouped by card or device used. We've also added digital wallet and subscription management so you can manage where your card information has been stored digitally by merchants and suspend or delete any card links no longer needed or trusted.

The Future of Banking, powered by Discovery AI

Introducing the next evolution in your banking experience: a private banking experience through WhatsApp to help you analyse spending and saving patterns, understand your accounts better, and receive tailored recommendations to maximise product features and rewards, powered by Discovery AI.

How it works:

- Personalised insights: Discovery AI uses advanced data models to analyse your spending and saving patterns, providing tailored recommendations to help you optimise your finances.

- Seamless support: Available on the Discovery Bank WhatsApp channel in your preferred language, you can interact through text, voice notes, documents, or images.

- Secure authentication: Authenticate securely in the banking app every time you access these functions.

- 24/7/365 assistance: Connect with Discovery Bankers instantly through text, supported by technology like our existing Live Assist solution for secure screen-sharing.

Stay tuned for more updates and innovations that will continue to enhance your banking experience with us!

Limits, terms and conditions apply. Discovery AI may make mistakes, and all answers should be verified before being relied upon. Responses should not be considered financial advice. For any financial advice, please consult a financial adviser.