August 2025

Qualifying clients enjoy 20% back from Old School

Discovery Bank clients have the opportunity to score big: qualifying clients will get 20% back in Điscovery Miles on all online or in-store purchases from Old School, until 30 September 2025.

Whether you're catching the boys in green and gold, enjoying a soccer game or tuning in for the big fight this weekend, we're here to elevate your shopping experience with unbeatable value and proudly local flair!

Here's how clients can take up this offer:

- Shop online or in-store at Old School by 30 September 2025: all store items are eligible.

- Pay for the purchase using your physical or virtual Discovery Bank card.

- Clients will get 20% of their transaction value back in Điscovery Miles - Điscovery Miles will appear in the Điscovery Miles Account once Old School has banked the transaction.

Clients with Discovery Bank Suites, Card Accounts and Transaction Accounts with bundled fees are eligible for this campaign.

Read the campaign terms and conditions here

Special offer: Clients can earn Discovery shares with EasyEquities

From 1 to 31 August 2025, EasyEquities clients who open a qualifying Discovery Bank product can earn R1 in Discovery shares for every R20 of qualifying spend on their Discovery Bank cards in September, capped at R2,000 in shares. Plus, Discovery Bank clients who open an EasyEquities account via the Discovery Bank app will earn R1 in Discovery shares for every 10 Discovery Miles accumulated in August, also up to R2,000.

For EasyEquities clients without a Discovery Bank account

If your client opens a qualifying Discovery Bank product in August and links their existing EasyEquities profile in the Discovery Bank app, they'll earn R1 in Discovery shares for every R20 of qualifying Discovery Bank card spend during September 2025. Depending on the product type, clients can earn up to R500, R1,000 or R2,000 in shares, also locked for five years.

For Discovery Bank clients without an EasyEquities account

If your client opens and funds a new EasyEquities account in August via the Discovery Bank app, they'll earn R1 in Discovery shares for every 10 Discovery Miles they earn during the month - capped at R2,000 in shares. Shares will be allocated by 31 October 2025 and locked for five years.

See full campaign terms and conditions here.

Reminder: how the engaged remuneration structure works

Advisers making 20 or more sales in a production month, where over 80% of the sales are non-credit (i.e., Transaction Accounts, and includes sales made by linked advisers) will automatically be moved onto Discovery Bank's engaged remuneration structure. Advisers will be notified by their Franchise Director or Business Executive should this occur, and all advisers unless advised otherwise remain on the normal remuneration structure as before. The engaged remuneration structure is intended to protect advisers and minimise the risk of future claw backs on non-credit sales due to low client engagement.

The engaged remuneration structure

With the engaged remuneration structure, we'll process referral fees for sales of Transaction Accounts with bundled fees only when a client makes a qualifying in-store or online card transaction of R1 or more (instead of on account opening) - this first transaction must happen within two months of the sales date. Advisers can use the Financial Adviser Platform to track card activations and check if the qualifying transaction has been made.

For example, if an adviser is on the engaged remuneration structure and onboards a client with a Transaction Account with bundled fees on 17 August 2025, but the client deposits money into their account and makes an in-store card purchase for the first time on 29 September 2025, the sale will only be processed and due for payment as part of the commission run in October 2025. However, if the client uses their card for the first time after 17 October 2025 (or never uses it), no referral fee will be paid on the sale.

Sales volumes and credit vs. non-credit mixed are monitored each month, and we reserve the right to recover referral fees paid and reverse recognition awarded where we have reason to believe there may be abuse of the Commission System and remuneration rules.

June 2025

Voted South Africa's best digital bank in Daily Investor survey

Discovery Bank was voted the most popular digital bank in the 2025 South African Investor and Banking Report, a survey by Daily Investor, a publication keeping millions of readers informed about the financial landscape in South Africa.

Digital convenience, unmatched security, 24/7 service and innovative rewards all added up to retail and institutional investors ranking Discovery Bank as their first choice.

Read why Discovery Bank secured the top spot.

View clients eligible to switch home loans with no bond registration fee

Your existing Discovery Bank clients with a home loan with another financial provider, may be eligible to switch their home loan to Discovery Bank. Until 30 June 2025, Discovery Bank will cover the bond registration fee for eligible clients with loan values exceeding R1 million.

View this limited time campaign under Product Opportunities on the Adviser Insights Dashboard by navigating to Adviser 360 > Prospects > Adviser Insights Dashboard. Use our content on Social 360 to further encourage your eligible clients to switch their home loan!

Read our latest news article for all the details. Campaign terms and conditions apply.

Vitality Money premium changes

The new Plan ring gives clients more ways to improve their financial health and Vitality Money status to unlock greater rewards. Clients can soon access free will drafting, and collection and storage services through Discovery Wills and Trust Services, in the Discovery Bank app. With the addition of this service in July, we'll be updating our Vitality Money monthly fees effective 1 July 2025. Our fees page shows the new fee per product.

Base Điscovery Miles updates

A Discovery Bank virtual card is the most convenient and secure way to spend online and in-store, and earns clients Ðiscovery Miles at the highest possible rate - up to 1 Điscovery Mile per R15. Effective 1 July 2025, spend on a physical card will earn base Điscovery Miles at 1 Điscovery Mile per R200, up to a set monthly spend threshold per product. Virtual card earn rates stay the same and apply to all qualifying spend on the virtual card.

Additional Discovery 911 services live

The Discovery Bank app is the gateway to essential emergency services with Discovery 911, providing clients with fast, convenient and reliable assistance when needed most. Clients can now request roadside and home assistance in the banking app (requesting an ambulance and logging an international medical emergency were already available). Read more about these services.

May 2025

Free game download with Steam digital vouchers

Your clients can get a full Doom Eternal PC game voucher for free when they buy a R1,000 Steam top up digital voucher in the banking app. Plus, with Ðiscovery Miles they get up to 15% off for even more gaming adventure!

This offer ends on 31 May 2025, so tell your clients not to miss out.

Learn more about Steam digital vouchers with Discovery Bank.

Exclusive offer: Clients still get eight free workouts

Discovery Bank clients get eight free workouts a month to use at over 350 facilities in the Vitality Fitness network. It's the perfect time for your clients to try something new, whether it's kickboxing, Pilates or a dance class!

Share our content on Social 360 and remind clients to take advantage of this offer before it ends in June 2025.

Read more about the Bank and Vitality Fitness special offer.

New research: What SpendTrend25 says about your clients' spending

The newly released SpendTrend25 report, developed by Discovery Bank in partnership with Visa, unpacks how South Africans are really spending across different income levels, cities, and lifestyles.

SpendTrend25 reveals what matters most when people choose how to pay, how they've used early withdrawals from retirement savings, and how AI is starting to shape personal finance.

Download SpendTrend25 now. Share your thoughts on socials using #SpendTrend25 and #DiscoveryBestBank, and tag Discovery.

Clients can still switch and save on bond registration fees!

If your clients switch their home loan to us by 30 June 2025, we'll cover their bond registration fee for up to R3 million of their home loan - a saving of up to R30,000. Read more.

Find shareable content on Social 360 and encourage your clients to switch today!

Coming soon - Keep a lookout for this campaign under Product Opportunities on the Adviser Insights Dashboard. You'll be able to request the campaign and view a list of existing clients in your Discovery book who could qualify for this limited-time offer.

Discovery AI is now available!

Discovery AI is being released to Discovery Bank clients starting this week. This cutting-edge artificial intelligence allows clients to analyse spending and savings patterns, understand their account functions, and receive tailored recommendations to maximise their rewards.

Clients experience Discovery AI through the Discovery Bank WhatsApp channel, in their preferred language, after securely authenticating in their banking app. They can ask Discovery AI for product and reward information using a text or voice note or by uploading an image or document.

How to start chatting with Discovery AI

To chat with Discovery AI, clients must have their WhatsApp registered with the same primary cellphone number listed under Contact Details in their Discovery Bank app. Then, clients should add the Discovery Bank WhatsApp number, +27 11 324 4844, to their contacts and type Hi on WhatsApp to start a session.

It's important to keep in mind that Discovery AI will continue to evolve. Clients can share feedback about their experience by replying with Give feedback or with an emoji to let Discovery AI know how well it's helped with a specific question.

Learn more about Discovery AI.

Another chance to celebrate Mom with Miles Ð-Day!

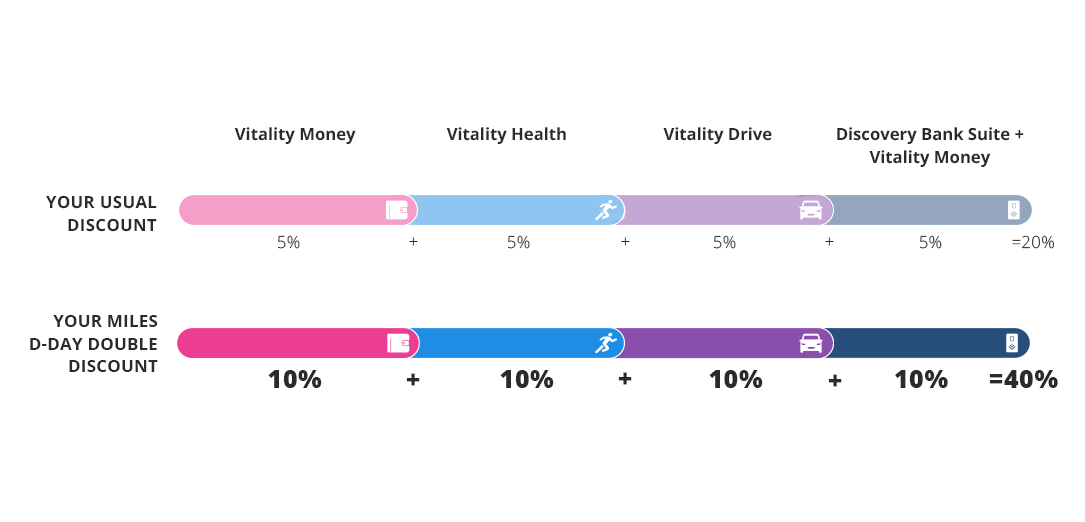

Mothers would walk a million miles for their children. This May, encourage your clients to use their Ðiscovery Miles to make her month extra special - with double discounts at over 40 Ðiscovery Miles retail partners like Clicks, NetFlorist and Pandora!

Qualifying Discovery Bank clients can get up to 30% off on Thursday, 15 May.

Find shareable content on Social 360 and read our article for more details. Ts&Cs apply.

April 2025

Your clients can unlock incredible home loan savings

From 1 April to 30 June 2025, when your clients switch their home loan to us, we'll cover the bond registration fees for up to R3 million of their home loan. That's a saving of up to R30,000 on bond registration fees. Read more.

Miles Ð-Day is four days away!

Miles Ð-Day is back on 15 April, just in time for the mini break! Encourage your qualifying Discovery Bank clients to stock up and get up to 30% off padkos, braai essentials, travel gear and more at our Ðiscovery Miles retail partners.

Find Miles Ð-Day shareable content on Social 360 and read our article for more details.

Exclusive offers: Get 8 free workouts and a shot at Ð1 million this month!

As a special offer, Discovery Bank clients get access to 8 FREE workouts at over 350 facilities in the Vitality Fitness network. Plus, they stand a chance to reveal Ð1 million when they play their Vitality Active Rewards gameboard this month. These are limited-time offers, so make sure your clients don't miss out.

Visit Social 360 to find shareable content and read the latest news articles for more information.

March 2025

Discovery Bank product and digital enhancements for 2025

At Discovery Bank, we believe that banking is no longer just about transactions, accounts or payments. Together, we're creating the next evolution of banking: intelligent, personal, secure and deeply connected to every aspect of our clients' lives.

Thank you to those who attended our exciting in-person and online events. If you couldn't make it, please access the online event recording for an exclusive walkthrough of The Future of Banking. Now.

We're enhancing the Discovery Bank offering in five key areas

- Financial wellness - incentivising better short-term and long-term financial habits through the introduction of financial planning and estate planning into the Vitality Money programme.

- Shared value - incentives directly linked to clients improving their financial position and engaging with Discovery Bank and Vitality Money, including limited-time offers with boosted incentives to drive engagement.

- Autonomy and control - providing clients with complete autonomy over their finances anytime, anywhere with the latest digital account and card management tools.

- Security and safety - a new suite of advanced banking security and fraud prevention features to counter increasing cyber and security risks.

- Intelligence and personalisation - Discovery AI introduces new data-driven tools to make clients' banking smarter and more intuitive.

Read the March 2025 Discoverer.

Keep a lookout for our upcoming online training session invitations in the coming weeks. Training sessions will take place mid-April 2025.

Experience Travis Scott LIVE in South Africa!

Internationally renowned Travis Scott is bringing his CIRCUS MAXIMUS TOUR to SA on 11 October 2025 at the FNB Stadium, Johannesburg.

Discovery Bank Transaction Account, Credit Card Account, Suite, Điscovery Account, and Discovery Card clients can enjoy a 48-hour pre-sale access to purchase up to 8 tickets from 09:00 on 26 March 2025 when paying with their Discovery Bank card.

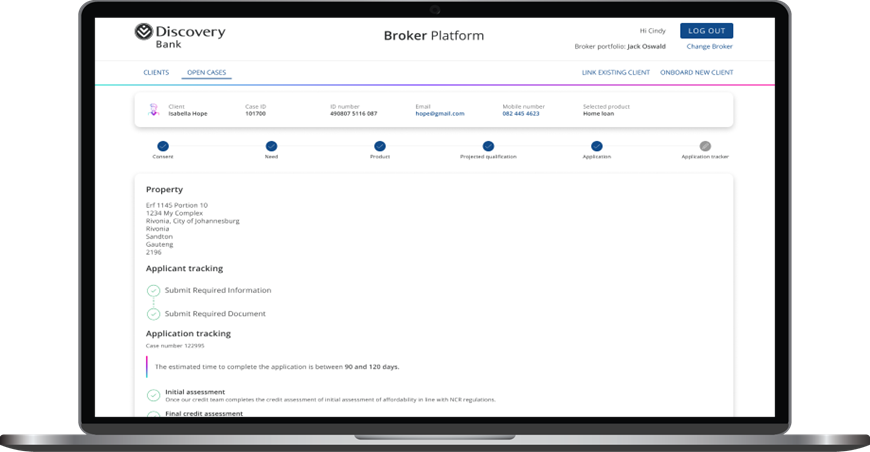

Track Home Loan applications from the Financial Adviser Platform

We've made it easier for you, as an adviser, to sell Discovery Bank Home Loans by letting you track the progress of your clients' linked Home Loan applications directly from the Financial Adviser Platform. This also removes the need for a manual Record of Services document to be submitted with applications, automating the referral fee payment process on successful sales.

Digitally linking your clients' Home Loan applications

Discovery Bank clients can now link their Home Loan applications to their Bank adviser on record, through the Discovery Bank app at the start of each application. Your clients will continue to submit the full end-to-end Home Loan applications in their own Discovery Bank app. Once their Home Loan application has been linked to you, you'll be able to monitor its progress from the Open Cases view on the Financial Adviser Platform, ensuring better pipeline management and support.

How to get linked to a Home Loan application at the start of the process:

- Your clients start a new Home Loan application in their Discovery Bank app, choosing between the New, Switch or Refinance options as usual.

- Once they've indicated they're the main applicant, your clients will select from a new option that pops up asking if they're being assisted by their bank adviser on record, which will link you to the application. Note that if a different adviser or no adviser is shown, an adviser appointment must be done on the Financial Adviser Platform first.

How to get linked to a Home Loan application after it has already been started:

If your client starts a Home Loan application without linking you at first, you can still submit a signed Record of Services form to Distribution Support. They'll then create the application linkage on your behalf.

For you to be recognised and earn a referral fee on successful Home Loan sales, the client must link you at the start of the application. Or you must submit a manual Record of Services document before the client signs their letter of acceptance.

Digitally tracking your Home Loan cases

Once linked, you can track your clients' Home Loan applications from the Financial Adviser Platform's Open Cases view.

Soon, franchise support teams will also have visibility through SmartTrack, similar to their current tracking of day-to-day bank account and credit card sales.

Home Loan cases started before 17 March, when this functionality became available in the Discovery Bank app, will need a manual Record of Services document submitted to Distribution Support. We're linking all previously submitted open Home Loan applications to advisers, and these will be visible on the Financial Adviser Platform by the end of March.

February 2025

Transaction Accounts now receive virtual cards on account opening

The benefits of virtual cards

Virtual cards are digital alternatives to physical cards and offer additional levels of safety and convenience. They come with their own expiry date, unique 16-digit card number, and CVV number, and provide access to the same benefits as physical cards, such as travel insurance, purchase protection, extended warranty, and rewards. Virtual cards are also issued instantly, allowing clients to start using them immediately for online shopping and tap-and-go payments with their preferred smart device.

Transaction accounts now receive virtual cards on account opening

From the end of February, the following changes will apply to Discovery Bank clients who join with or upgrade to a Transaction Account (either with pay-as-you-transact fees or bundled fees):

- Clients will receive a virtual card in the app upon account opening, which they can use to transact with immediately.

- Clients will be able to order their first physical card at no cost after opening their account, once they've deposited R250 or more into their Discovery Bank accounts.

There is no change to the process for clients with a Credit Card Account or Suite, who will continue to receive physical cards on account opening.

Card eligibility and adding a physical card

|

Product type |

Physical card |

Virtual card |

|

|

Credit Card Accounts and Suites |

Created during account opening process, and can be added at any time after account opening (first physical credit card free) |

Can be added at any time after account opening (virtual cards are free) |

|

|

Transaction Accounts (with pay-as-you-transact or bundled fees) |

Can be added after account has been opened, and R250 or more has been deposited into accounts (first physical debit card free) |

Created during account opening process, and can be added at any time after account opening (virtual cards are free) |

|

|

Ðiscovery Account with zero-monthly fees |

Physical card not available |

Created during account opening process (virtual card is free) |

|

|

Savings accounts |

No physical or virtual cards available on this product |

||

Assisting your clients with setting up and using their virtual cards and funding their accounts will lead to an improved client onboarding journey, and reduce the time taken to start experiencing great rewards from Vitality Money. For more information on how your clients can quickly add funds to their account, start using their virtual cards and add a physical card if desired, refer to the following Discovery Bank Info and tips content:

- How do I deposit money into my Discovery Bank account from another bank?

- What is a virtual card?

- Where can I view the details of my Discovery Bank card?

- How do I set up my smart device for tap-and-go payments?

- How do I order a Discovery Bank physical card?

December 2024

2024 highlights and fees and rewards adjustments for 2025

And just like that, 2024 is winding down and most of South Africa is preparing to take a breath before the new year. It has been our joy and privilege to bring your clients more value, rewards and innovation in 2024 - making sure that 2024 is your client's most rewarding year yet.

Some of our personal highlights include:

- Launching Discovery Bank Home Loans and seeing how our clients got rewarded with not only an additional up to 1% off their loan interest, but also up to 30% back on their purchases in our newly launched home partner network!

- Celebrating our 1 Millionth Client with some great competitions and beautiful data art, and marking our 2 Million Accounts milestone by giving away Ð2,000,000!

- Welcoming Checkers as our new HealthyFood partner and making eating healthy even easier and more affordable with up to 75% back on thousands of HealthyFood items, in-store and online with Checkers and Checkers Sixty60 and Woolworths Food in-store and online, Woolies app and Woolies Dash.

- Bringing our Discovery Bank Buddy to life and seeing how he spreads joy, laughter and fun wherever he goes (if you haven't met him yet, pop by our Discovery offices and take a photo.)

- Welcoming United Airlines to the Vitality Travel international discounted flights partner network - ensuring that our clients can enjoy up to 75% off flights directly to and within the USA.

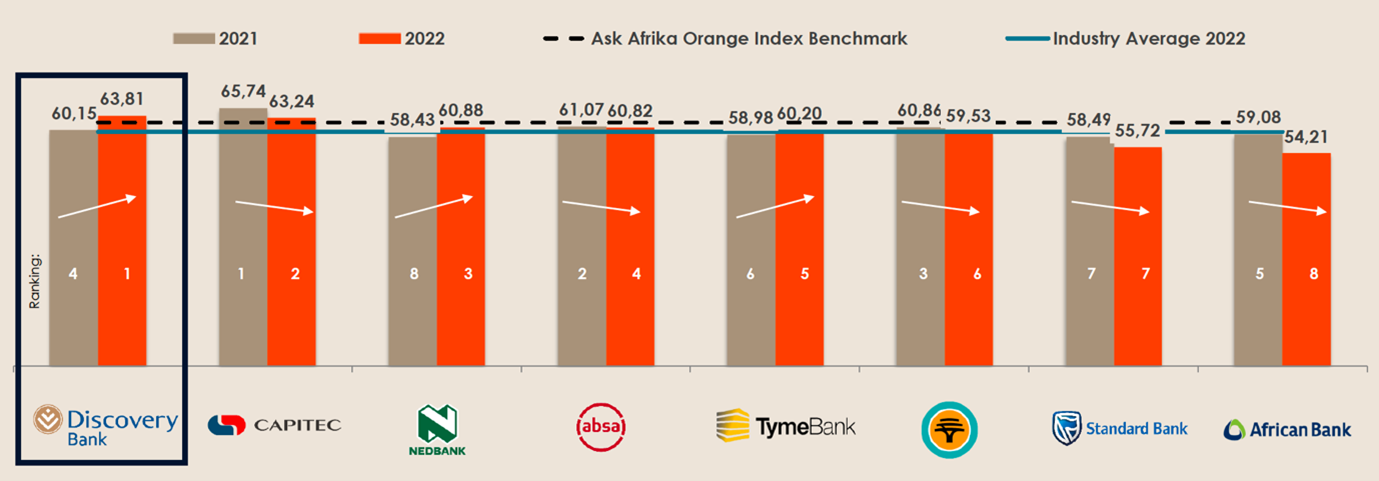

- Being voted the #1 Bank in SA for delighting clients and, of course, being voted the Best Retail and Private Bank in SA when it comes to client service and customer experience - for the third year in a row!

Fees and rewards adjustments for 2025

Our monthly fees and some transaction charges will be increasing from 1 January 2025. Clients can continue to enjoy our full range of savings accounts and their competitive interest rates at no monthly cost.

| Product | 2025 monthly fees |

|---|---|

| Ðiscovery Account | R0 |

| Gold Transaction Account with pay-as-you-transact fees | R30 |

| Platinum Transaction Account with pay-as-you-transact fees | R70 |

| Black Transaction Account with pay-as-you-transact fees | R120 |

| Gold Transaction Account with bundled fees | R155 |

| Platinum Transaction Account with bundled fees | R250 |

| Black Transaction Account with bundled fees | R350 |

| Gold Credit Card Account | R110 |

| Platinum Credit Card Account | R165 |

| Black Credit Card Account | R250 |

| Gold Suite | R229 |

| Platinum Suite | R314 |

| Black Suite | R569 |

| Purple Suite | R679 with annual card fee of R4,000 |

For the first time since launching Discovery Bank in 2019, we'll also be adjusting the spend requirements for dynamic lifestyle rewards. Clients will now need a minimum monthly qualifying spend of R3,000 a month to earn Vitality Money rewards from their HealthyFood, HealthyCare, HealthyBaby, Fuel and Uber, and Life Integrator Miles benefits, as well as to be able to access The Lounge. Vitality Money travel rewards and the Home Partner Network benefit will have a minimum average monthly qualifying spend of R3,000 a month.

See below for the full fee schedules within each Discovery Bank Collection, and watch our video of some of our highlights for 2024:

- Gold Collection 2025 fees

- Platinum Collection 2025 fees

- Black Collection 2025 fees

- Purple Suite 2025 fees

New PayShap feature: Send payment requests using a cellphone number

PayShap is an interbank payment scheme that lets clients instantly pay or be paid without needing, or giving out, bank account details. With the newly launched PayShap Request feature, clients can conveniently send and receive requests for payment across all participating banks, with real-time payments starting from just R1.

Encourage your clients to register for this new feature by setting up a ShapID in their banking app. Simply tap More from the bottom menu, tap PayShap, and follow the registration steps.

Home loans and credit training webinar recordings

Over the past two months, the Discovery Bank Technical Marketing team have hosted several home loan and credit card application training webinars. These webinars aimed to improve your understanding of application processes, and to provide tips and tricks on how to streamline home loan and credit card application processes for clients.

Access recordings on the DIT portal using these links:

- Tips for increasing credit application conversion rates

- How to market and sell Discovery Bank Home Loans

November 2024

Further enhancements to the credit application process

In May 2024, we improved accessibility to our credit products by offering lower credit limits to eligible clients using updated assessment criteria. Through this initiative, we've been able to provide clients with credit cards that have limits of between R300 and R750 by lowering some of the credit limit requirements.

To further enhance this process, we're streamlining the document submission requirements for clients identified as eligible for low limit credit offers. If a client is preliminarily approved by the system and receives an offer for a low limit credit product, they will not be required to upload supporting documents for income verification purposes.

For these select cases only, the Financial Adviser Platform will automatically reflect 'Income Documents Verified' under the document upload section of the credit application process. If the system does not automatically reflect this message, the client was not identified as eligible for the supporting document requirement waiver. For all other credit applications, including those where clients are preliminarily approved for standard limits of R10,000 or more, income verification documents will be required as normal.

Complimentary Emirates Skywards Silver status for Black and Purple Suite clients

From 1 October 2024 to 31 March 2025, Discovery Bank Black and Purple Suite clients booking an Emirates flight on Vitality Travel and departing before 1 January 2026, will enjoy the benefits of Emirates Skywards Silver status, such as complimentary seat selection, priority check-in and boarding, complimentary access to the Emirates Business Class Lounge in Dubai, excess baggage allowance of 12kg, free onboard Wi-Fi and more.

Clients who have already booked an Emirates flight on or after 1 October 2024 can still enjoy this limited time offer if they add their Skywards number to their Vitality Travel profile on the Discovery Bank website or in the Discovery Bank app at least ten days before their departure date.

The six-month promotional offer is valid from 1 October 2024 to 31 March 2025. This promotion applies to flights departing by 31 December 2025. Any tickets booked during the promotional period but with travel dates starting 1 January 2026, will not be eligible for the promotional benefits.

What your clients need to do to activate their Emirates Skywards Silver tier benefits

Discovery Bank Black and Purple clients will need to:

- Create an Emirates Skywards profile on the Emirates website.

- Book an Emirates flight on the Vitality Travel booking platform between 1 October 2024 to 31 March 2025. The flight booking must be at least six weeks in advance to get their maximum discount as well as to qualify for this promotion.

- Enter their Skywards number on the Vitality Travel booking platform or Discovery Bank app.

- Check in for their flight online at least 24 hours before departure to activate their Emirates Skywards Silver status.

- Clients who did not provide their Emirates Skywards number during the booking process need to add their Emirates Skywards number on the Vitality Travel booking platform or in the Discovery Bank app at least ten days before their departure date and check in online for their Emirates flight at least 24 hours before departure to activate their benefits.

- Is your client travelling with someone on their policy? An adult member on their flight booking may also earn an Emirates Skywards Silver tier upgrade if they add their Skywards number in the Discovery Bank app at least ten days before departure.

How clients can enter their Emirates Skywards number in the Discovery Bank app:

- Log in to the Discovery Bank app.

- At the bottom of the screen, tap Transact > Travel.

- Tap on the 'Travellers' icon on the top right of the screen.

- Tap on the traveller they would like to add an Emirates Skywards number for, scroll down to the bottom of the page and tap on Loyalty memberships.

- Select Emirates Airlines and add their Emirates Skywards number.

Read more here. Terms and conditions apply.

Important tips for onboarding foreign national clients

Remember that foreign nationals without SA ID numbers who have qualifying passports and visas are now able to join Discovery Bank - if they have other active Discovery products, or if they've previously had a Discovery product. Giving even more of your clients access to our incredible benefits like Vitality Travel and Ðiscovery Miles, the powerful Discovery Bank app, and integration benefits that are available through the rest of the Discovery composite.

Guidelines for submitting documents

To support the wide range of passport types and layouts used by your clients from countries around the world, we use a third-party party to service to verify all foreign passport document submissions. This service is highly sensitive, and below are some guidelines to please share with your clients when uploading documents through their Discovery Bank app to ensure it's as seamless a process as possible:

- Take a clear photo, with nothing obstructing the document e.g. fingers

- Ensure there are no shadows over the document

- Good lighting but no reflections or glare e.g. from a flash or light

- Documents should be placed on a solid dark background e.g. dark table

- Pictures should not be taken from their computer screen as there are watermarks on the document that will not be visible

- Images must not be scanned as there are watermarks on the document that will not be visible

- Images must be positioned in line with the screen of the phone. The image should be straight

- Images must be zoomed in as much as possible without cutting off the document.

Important information to consider when uploading a foreign national client's permit

If a client's permit has expired, both the expired permit and VFS receipt of the new application should be uploaded. If the passport number on the valid permit does not match the valid passport that the client submitted, the client's previous passport document will be required.

In some cases, we see that the client has supplied us with their newest passport number, but the Discovery group systems have their old passport number. Please encourage your clients to ensure that their personal information is always up to date for their other Discovery policies.

Foreign national clients wanting a secondary card

At this time secondary cards can't be issued to foreign nationals without SA ID numbers. However, foreign national primary accountholders (who themselves don't have an SA ID number) can issue secondary cards to others with South African ID numbers.

Tools to help you identify eligible foreign national clients and support your sales efforts

Take advantage of our new foreign national sales campaign under Product Opportunities on the Adviser Insights Dashboard: Eligible foreign nationals can now join Discovery Bank.

Once the campaign is requested, you can view a list of existing clients on your Discovery book that are eligible for each campaign.

Access the Adviser Insights Dashboard here, or follow the path below from the main menu on Adviser 360 once you have logged in:

Adviser 360 > Prospects > Adviser Insights Dashboard > Product opportunities > Bank

Need help? View the user guide and training videos: Adviser 360 > Marketing Support > Adviser 360 Info Hub

More information on onboarding foreign nationals

Read more information on who is eligible to join as a foreign national in this previous eDiscoverer article, or find more information on Bank Info and tips.

October 2024

Removal of six-month upgrade rule until June 2025

Currently, Discovery Bank pays boosted referral fees where applicable on any upgrades made through a client's own Discovery Bank app where the upgrade occurs within six months of a broker appointment date. However, for upgrades made between 26 October 2024 and 25 June 2025, we'll be running a special campaign where we remove this six-month upgrade rule, and automatically recognise all upgrades as broker-assisted regardless of appointment date. This offers advisers increased opportunities to earn referral fees, case count and production on your existing Discovery Bank client book.

The referral fee will continue to be calculated as the difference between the equivalent referral fee on the previous product and the referral fee on the new product. It doesn't matter how the client originally joined Discovery Bank (i.e. themselves or through you or another adviser). Remember that to earn referral fees on an upgrade, you must be the Discovery Bank adviser on record at the time the client completes their product upgrade in their own Discovery Bank app.

Primary product referral fees as of October 2024 (excl. VAT)

|

Low limit |

Standard limit |

||

|

Transaction Account with bundled fees (any colour) |

R750 (no limit) |

||

|

Gold Credit Card Account |

R750 |

R1,100 |

|

|

Gold Suite |

R1,000 |

R1,500 |

|

|

Platinum Credit Card Account |

R1,000 |

R1,650 |

|

|

Platinum Suite |

R1,350 |

R2,100 |

|

|

Black Credit Card Account |

R1,250 |

R2,200 |

|

|

Black Suite |

R1,750 |

R3,000 |

|

|

Purple Suite |

- |

R3,000 |

|

Please note:

- An upgrade referral fee is paid when a client moves from one product to a higher product (with the fee determined based on whether they stay on a low limit, move from low limit to standard limit, or stay on a standard limit), but not when they move from having a low limit to a standard limit on the same product. For example:

- A client moving from a low limit Gold Credit Card Account low limit to a Gold Credit Card Account to a standard limit will earn no referral fee, because there was no product change.

- A client moving from a low limit Gold Credit Account low limit (R750) to a low limit Gold Suite low limit (R1,000) will earn a referral fee of +R250 because there was a product change.

- A client moving from a low limit Gold Credit Account low limit (R750) to a low limit Gold Suit standard limit (R1,500) will earn a referral fee of +R750 because there was a product change and a move from low limit to standard limit.

- Sales are monitored and we reserve the right to recover referral fees paid and reverse recognition awarded where we have reason to believe there may be abuse of the Commission System and remuneration rules.

Viewing your opportunities and tracking sales

Bank accredited advisers can see a real-time view the current product held by each client linked to them under the CLIENTS list on the Financial Adviser Platform. Franchise Directors and Business Executives can view an aggregated opportunity view in their monthly opportunity packs received from Retail Distribution. Please note the below:

- Referral fees and recognition on upgrades will continue to only be processed at the end of the month and won't reflect in daily production files. We are working to improve this reporting in future.

- All other standard remuneration rules will continue to apply.

Find steps for how clients can upgrade their product within their Discovery Bank app on Bank Info and tips.

Monitoring for high-quality Discovery Bank sales

Advisers making 20 or more sales in a production month where over 80% of the sales are non-credit (i.e., Transaction Accounts, which include sales made by linked advisers) will automatically be moved onto Discovery Bank's engaged remuneration structure. Advisers will be notified by their Franchise Director or Business Executive should this occur, and all advisers unless advised otherwise remain on the normal remuneration structure as before. The engaged remuneration structure is intended to protect advisers and minimise the risk of future claw backs on non-credit sales due to low client engagement.

The engaged remuneration structure

With the engaged remuneration structure, any referral fees for sales of Transaction Accounts with bundled fees are only processed when a client completes a qualifying point-of-sale (POS) card transaction of R1 or more (instead of on account opening). This first transaction must occur within two months of the sales date. Advisers can track card activation and if the qualifying transaction has been made using the Financial Adviser Platform. Importantly, all Credit Card Account and Suite sales remain unaffected by this change and are still paid on account opening.

For example, if an adviser is on the engaged remuneration structure and onboards a client with a Transaction Account with bundled fees on 17 October 2024, but the client only deposits funds into their account and makes an in-store card purchase for the first time on 29 November 2024, the sale will only be processed and due for payment as part of the commission run in December 2024. However, if the client only uses their card for the first time after 17 December 2024 (or never uses it), no referral fee will be paid on the sale.

Sales volumes and credit vs. non-credit mixed are monitored each month, and we reserve the right to recover referral fees paid and reverse recognition awarded where we have reason to believe there may be abuse of the Commission System and remuneration rules.

Increasing your credit application conversion rates

If you haven't joined one of the Credit Bootcamp webinars yet, we encourage you to see the eDiscoverer shared on Thursday, 26 September 2024 for containing dates and registration links of for sessions occurring monthly for the rest of the year.

New campaigns on Adviser 360

Take advantage of our new sales campaigns under Product Opportunities on the Adviser Insights Dashboard:

- Limited offer: Vitality Health clients can get a R1,000 voucher to spend at Checkers or Woolworths if they join Bank by 30 November 2024 (Campaign information and terms and conditions available here).

- Eligible foreign nationals can now join Discovery Bank (More information available here).

Campaigns will be available from 11 October 2024. Once requested, you can view a list of existing clients on your Discovery book that are eligible for each campaign. Remember to use our marketing and social media content available on Social 360 to support your sales efforts.

Access the Adviser Insights Dashboard here, or follow the path below from the main menu on Adviser 360 once you have logged in:

Adviser 360 > Prospects > Adviser Insights Dashboard > Product opportunities > Bank

Need help? View the user guide and training videos: Adviser 360 > Marketing Support > Adviser 360 Info Hub

Discounted flights to the USA with United Airlines

Discovery Bank clients now get up to 75% off direct flights to the United States with United Airlines when booked through Vitality Travel.

United Airlines adds to Vitality Travel's network of international discount flight partners which includes British Airways, Emirates, and Qantas, as well as local flight partners Airlink, CemAir, FlySafair, Lift, and SAA.

Another reason for your clients who haven't yet joined, to join Discovery Bank today! Read more.

Up to 15% back on purchases from Incredible

Discovery Bank clients already enjoy up to 15% back in Ðiscovery Miles at our Home Partner Network which includes Coricraft, Dial-a-bed, Nespresso, Patio Warehouse and Volpes.

Since 1 October they can also equip their home with the latest in-home appliances, tech, smart home-devices, security systems, WiFi solutions, and more at Incredible, our newest home partner.

Plus, until the end of 2025 clients can double their reward for six months if they have a Discovery Bank Home Loan. Read more.

Coming soon: Two-pot withdrawals in the banking app

Discovery Retirement Fund members who are Discovery Bank clients will soon enjoy the most secure and convenient two-pot withdrawal process in the Discovery Bank app. Clients can submit requests in the banking app in under 60 seconds. Money will be deposited securely into a linked Discovery Bank account within three business days, following SARS clearance.

Encourage your Discovery Retirement Fund clients without a Discovery Bank product to sign up today! Read our news article.

More convenient and secure card deliveries

Your clients will now receive a "Delivery Confirmation PIN" from DSV, our courier partners, for face-to-face delivery of new Discovery Bank cards. This PIN, sent via SMS on the day of delivery, allows clients (or a trusted third-party) to receive the new card without ID verification. If the PIN is lost or the delivery device fails, ID verification will be required.

September 2024

Home Loan social media material available on Social 360

Check out our new Discovery Bank Home Loans marketing and social media content available on Social 360. Easily share videos, stories and images inviting your clients to apply for new loans or switch existing home financing to Discovery Bank.

Remember that you can also find answers to many Home Loan product related questions on Bank Info and tips.

Take advantage of our R1,000 special offer

Access our special offer Social 360 content and encourage your Vitality Health members to join Discovery Bank. Vitality Health clients who join before the end of November 2024, and meet the qualifying criteria, will receive a R1,000 voucher to spend at their primary in-store HealthyFood partner of choice. Don't let your clients miss out on this delicious deal!

Read our latest news article for all the details.

Discovery Bank enhancements for 2024

This has been another year of exceptional growth for Discovery Bank, marked by welcoming our one millionth client, and the launch of Discovery Bank Home Loans. Here are some new and upcoming enhancements that will offer your clients even more value from their banking products:

A premium travel benefit and experience

With Vitality Travel, we offer your clients an end-to-end travel booking platform with the widest choice, convenience and incredible value.

- Our international discount flight network is growing with the inclusion of new airline partner United Airlines, offering up to 75% off direct flights to the United States!

- Discovery Bank Black or Purple Suite clients booking an Emirates flight on Vitality Travel will enjoy the benefits of Emirates Skywards Silver status, such as complimentary seat selection, priority check-in and boarding, complimentary access to the Emirates lounges in Dubai, free onboard Wi-Fi and more.

Home partner network enhancements

Coming soon, your clients will enjoy up to 15% back in Ðiscovery Miles on the latest technology, entertainment and appliances from Incredible Connection. This expands the existing home partner network, which offers rewards at Coricraft, Dial-a-Bed, Nespresso, Patio Warehouse and Volpes.

Remember that this doubles to up to 30% back as a special offer for clients with a Discovery Bank Home Loan - now extended for applications submitted until the end of 2025.

Streamlining payments and transfers in the app

- Discovery Retirement Fund members enjoy simple and secure two-pot withdrawals from the Discovery Bank app. Submit requests in just a few taps, with money deposited securely into a linked Discovery Bank account in three business days.

- Clients can already make instant payments to other South African bank accounts, but soon they'll be able to request instant payments too.

Making it easier for more clients to join

- We've lowered credit limit requirements on credit card products. The credit risk indicator on the Financial Adviser Platform, which gives you greater confidence in offering credit products to your clients, will soon be enhanced to indicate which of your clients may be eligible to join with a lower limit.

- Foreign nationals with qualifying visas and passports are now able to join in the Discovery Bank app.

- Vitality Health members who join Discovery Bank and meet qualifying criteria before the end of November 2024 can receive a R1,000 voucher to spend at their primary in-store HealthyFood partner of choice.

Read the Bank Discoverer.

Limited offer: New Discovery Bank clients can get R1,000

All Vitality Health members who meet the qualifying criteria listed below will get a R1,000 voucher on us to spend at their primary in-store HealthyFood partner:

- Join Discovery Bank with a qualifying product by 30 November 2024

- Activate the HealthyFood benefit and spend R1,000 with their Discovery Bank card within thirty days of joining.

See Social 360 for limited offer promotional content to share with your clients. Read our latest news article.

Get ready to experience Sting in SA!

17-time Grammy Award winner, Sting, will be in South Africa in March 2025 to perform his "Sting 3.0" tour in Pretoria and Cape Town.

Clients can visit ticketmaster.co.za now to book up to eight tickets per venue.

The Discovery Bank client pre-sale opened on 11 September 2024. Read more about the Sting tour.

August 2024

Foreign national Discovery clients can now join Discovery Bank

Foreign nationals without SA ID numbers are now able to join Discovery Bank - if they have other active Discovery products. This will give even more of your clients access to our incredible benefits like Vitality Travel and Ðiscovery Miles, the powerful Discovery Bank app, and integration benefits that are available through the rest of the Discovery composite.

How to onboard foreign national clients

All foreign nationals without SA ID numbers need to join Discovery Bank directly using their Discovery Bank apps - that means it isn't possible to help them with their application using the Financial Adviser Platform (FAP). However, once they've joined you can become their Bank servicing adviser on record using the quick digital broker appointment process on the Financial Adviser Platform.

To earn referral fees and recognition for helping foreign national clients who join Discovery Bank, you'll need to:

- Assist the client onboard to their desired product using their Discovery Bank app.

- Perform a broker appointment using the FAP.

- Complete a manual Record of Advice document (a new manual record of advice will be provided soon), have your client sign it, and submit it to Discovery Bank Distribution Support. Referral fees and cases will be processed and reflect in sales reports at the end of the production month.

Who is eligible to join as a foreign national

A foreign national is anyone who isn't a South African citizen. Foreign nationals with permanent residency and SA ID numbers have been able to join Discovery Bank since its launch in 2019. Now we're able to invite foreign nationals with valid passports and valid qualifying visas to apply to join Discovery Bank as well!

For now, this is limited to foreign nationals who already have a relationship with Discovery, where they have:

- An active medical aid policy administered by Discovery Health; or

- An active Discovery Life, Discovery Invest or Discovery Insure policy; or

- The previous Discovery Card from before the launch of Discovery Bank.

Additionally, clients must also have:

- Proof of South African residential address for FICA verification.

- A passport and qualifying resident visa that's valid for at least 12 months from the date of applying to join Discovery Bank. Clients with expired visas who've already applied for a visa extension can apply using a valid VFS receipt until they get their visa.

- Income verification documents will be required if applying for credit products.

Note that in line with the Financial Intelligence Centre Act (FICA), Discovery Bank is required to repeat all FICA verifications for foreign national clients every 12 months.

Product eligibility rules based on foreign national visa type

| text | Previous Discovery Card client* | Active medical aid, Life, Invest or Insure policyholder | text | |

|---|---|---|---|---|

| Visa type | Credit products (Suite or Credit Card Account) | Credit products (Suite or Credit Card Account) | Non-credit products (Transaction Account, savings or zero-monthly Ðiscovery Account) | |

| Permanent resident permit | ||||

| General work visa | ||||

| Critical skills work visa | ||||

| Intra-company transfer work visa | ||||

| Corporate visa | ||||

| Visitor's visa section 11(6) | ||||

| Retired person's visa | ||||

| Study visa | X | |||

| Spousal or life partner visa | X | |||

*Existing Discovery Card clients can upgrade their card colour or change their product when they upgrade in the banking app, but their existing card limit will apply to the upgraded Discovery Bank product. If they have a resident permit that qualifies for credit, they can apply for a credit limit increase after joining.

Unfortunately, foreign nationals with other visa types can't apply for any Discovery Bank account, as they are only valid for a short term and typically don't allow the holder to work in South Africa.

See more about foreign national product availability and usage on Discovery Bank Info and tips here. For any additional assistance please email or call the Discovery Bank Distribution Support team.

May 2024

Introducing lower credit limits to increase approval rates

As part of our commitment to responsible lending, Discovery Bank is updating its credit card approval process to enhance accessibility for clients. Clients must always pass both a risk and affordability assessment to qualify for any new credit limits. As it stands, Discovery Bank requires a minimum credit limit of R10,000 to be approved for a new credit card product.

Lowering the minimum credit limit requirement

Discovery Bank is lowering the minimum credit limit requirement, making it easier for eligible clients to be approved for a credit card. This change will result in a higher approval rate for clients who may have been declined previously due to the minimum limit of R10,000.

Presently, clients who don't qualify for the R10,000 minimum limit are declined for a credit card product. From 27 May 2024, clients who pass the affordability assessment but do not meet certain risk assessment criteria will be offered a limit of up to R750. This provides an opportunity for these clients to establish a credit history with Discovery Bank, with the potential to apply for higher credit limits in the future after demonstrating responsible credit behavior.

Key information to know

- Same product features and benefits: Clients with lower limits will be on the same products, and enjoy the same features, benefits, and functionalities as those with standard limits. They will also be subject to the same credit repayment obligations. However, they will not incur a monthly single credit facility fee.

- Same application process: It will not be possible to select a lower limit upfront during product selection. Financial advisers will follow the standard application and product selection process using the Financial Adviser Platform already in place today. The key change is that if a client is not approved for the minimum limit of R10,000, they will be assessed to determine eligibility for the up to R750 limit.

- Updated assessment criteria: Clients will still need to pass both the risk and affordability assessments, but there will be additional leniency on certain aspects of the risk assessment.

- Lower credit limits: Clients approved for a lower limit on a Gold Credit Card Account, Gold Suite, or Platinum Credit Card Account will receive a limit of R300. Those approved for a lower limit on a Platinum Suite, Black Credit Card Account, or Black Suite will receive a limit of R750. Lower limits will not be available for other Discovery Bank products, including the Purple Suite.

Referral fees and recognition

The sale of credit card products with low limits will still count as one case towards recognition. However, due to the higher risk and lower fees associated with these products, a reduced referral fee will be paid upon account opening.

| text | text | Existing referral fee on standard limits rest of FY24* | New referral fee on lower limits FY24 |

|---|---|---|---|

| Credit Card Account | Gold | R1,375 | R750 |

| Platinum | R2,063 | R1,000 | |

| Black | R2,750 | R1,250 | |

| Suite | Gold | R1,875 | R1,000 |

| Platinum | R2,625 | R1,350 | |

| Black | R3,750 | R1,750 |

*Including 25% boost campaign applicable only to face-to-face advisers and excludes call centres.

For any questions on the lower limit process and offering, please contact Discovery Bank Distribution Support.

Welcome Home Loans!

We are proud to announce the official launch of Discovery Bank Home Loans which is a significant addition to our retail banking products and a great opportunity for you as a Financial Adviser. This development not only expands Discovery Bank's offerings but also empowers you to provide more comprehensive solutions to your clients through Discovery Bank, Discovery Insure, and Discovery Life.

There are over R270 billion worth of home loan balances held by Discovery Bank clients, currently all with other banks and financial providers. More than half of these clients have an existing relationship with a Discovery adviser - don't miss out on the opportunity to help your clients switch as soon as possible!

The Discovery Home Ecosystem

Your clients get access to a full ecosystem of benefits and tailor-made service. They get a personalised interest rate and a further discount of up to 1% on their home loan, when they manage their money well and include their Discovery products.

Soon, we'll be introducing our home partner network where clients can get up to 15% back in Ðiscovery Miles on everything at Dial-a-bed, Coricraft, Nespresso, Patio Warehouse and Volpes when they use their Discovery Bank virtual card. And, as a special offer, clients with a Discovery Bank Home Loan, will have their reward doubled to up to 30% back for the first six months of their home loan.

When this new benefit goes live, clients will no longer earn base Ðiscovery Miles at these stores, but will enjoy up to 30% back on all their qualifying spend, based on their products, Vitality Money status and average annual spend.

Watch this video that you can share with your clients that showcases the full offering of the Discovery Home Ecosystem.

Training and requirements

To ensure you're equipped to assist clients with Discovery Bank Home Loans, it's essential to complete the necessary training and assessments on the Discovery Institute of Training (DIT) portal. In addition to meeting standard requirements, such as being licensed for FAIS categories 1.17 and 1.18, you'll need to complete the Discovery Bank Home Loans assessment on the DIT portal and have a case count of at least ten recognised Discovery Bank sales or upgrades in FY23 or FY24.

We automatically track the completion of the DIT Home Loans assessment, so you don't have to provide proof of completion. If you're unsure of whether you've already met the 10-case count requirement, please check the production reports at your franchise. Please note Discovery Bank Distribution Support is not able to confirm these requirements for you.

Sales process

1. You must be the Discovery Bank adviser on record.

- If a client is listed under the CLIENTS tab on your Discovery Bank Financial Adviser Platform profile, you are currently their adviser on record.

- To become the Bank adviser on record, click LINK AN EXISTING CLIENT on the Financial Adviser Platform and complete the quick digital appointment process.

2. Your client will apply for their home loan through their own Discovery Bank app.

- A step-by-step user guide to assist you and your client with this process will be available mid-May 2024. Remember, you will not complete the application using the Financial Adviser Platform.

- To earn referral fees on the Discovery Life Home Loan Protector in addition to the Discovery Bank Home Loan, your client must select that they are interested in being contacted by Discovery Life during the application process in the Discovery Bank app.

3. You must submit a signed Record of Services document to Distribution Support.

- You and your client must sign this document and submit it to DistributionSupport@discovery.bank within 48 hours of the client submitting their Discovery Bank Home Loan application. Without this form, Distribution Support will not be able to provide you with application updates or recognise or remunerate you for the sale.

- To be the Financial Adviser on record for a new Discovery Insure policy, please complete a Discovery Insure financial adviser appointment form and submit to INSURE_HOMELOANS@discovery.co.za at the same time as you submit the Record of Services document.

Marketing and support tools

Later this month, the Discovery Bank team will be rolling out a range of tools to help you target and assist your clients with their applications. This includes:

- Viewing Switch opportunity leads on your existing Discovery book on Adviser 360 under Product Opportunities (available mid-May 2024).

- Sharing marketing and social media content with your clients on Social 360 (available mid-May 2024).

- Assisting your clients in calculating their potential interest savings with an Excel home loans calculator (available mid-May 2024).

Remuneration and recognition

The standard remuneration fees on a Discovery Bank Home Loan range from 0.1% to 0.3% of granted home loan limits. As a special launch offer, Discovery Bank will be paying a flat 0.3% fee on all taken-up home loans with applications submitted before 30 June 2024.

Please note:

- Successful Discovery Bank Home Loan sales will count as one Discovery Bank case.

- Successful uptake of the Discovery Life Home Loan Protector will count as one Discovery Life case.

For advisers using the GrowthHouse Bank Referral Desk, they will be able to assist clients with home loan applications and follow the existing 100% recognition and 50% remuneration fee split already in place for day-to-day bank accounts and credit cards.

Support

Our dedicated Discovery Bank Distribution Support team is here to assist you every step of the way. Whether you have queries about the application process or require guidance on leveraging our tools effectively, we're here to help.

April 2024

Home Loans Roadshow wrap-up

Thank you to all those who attended the Discovery Bank Home Loans Roadshow sessions in Johannesburg, Durban and Cape Town, as well as the national virtual session. Content covered included the Discovery Home Ecosystem offering, the end-to-end sales process, and planned tools and campaigns to market to your clients.

Recording and assessment available on the DIT portal

If you missed it or want to revisit the content, the virtual session recording is available on the DIT portal, where you can also download the training presentation. If you didn't attend the in-person or virtual session, you'll need to watch the recording before you can start selling Discovery Bank Home Loans.

The Discovery Home Loan assessment is now live on the DIT portal and you must complete this before you can start selling Discovery Bank Home Loans. Bank accredited advisers who complete the assessment before 22 April 2024 will receive early access to apply for their own home loans from next week.

Keep a lookout for information in upcoming eDiscoverers on launch dates, opportunities, sales tools and support as we roll out the home loan offering to your clients in the coming weeks.

Robbie Williams is coming to SA in 2025!

Enjoy an electrifying evening filled with iconic hits and unforgettable performances. Plus, stay tuned as more special guests are announced.

Discovery Bank Transaction Account, Credit Card Account, Suite, Ðiscovery Account, and Discovery Card clients get #DiscoveryBank48hours pre-sale access to Calabash South Africa tickets.

The pre-sale opened on 10 April 2024. Clients can visit ticketmaster.co.za to book up to ten tickets per venue. All they need to do is:

- Register or log in to their Ticketmaster profile.

- Select Find tickets next to the Discovery Bank pre-sale event link.

- Pay with their Discovery Bank card or Discovery Card at checkout.

The first event takes place on 18 January 2025 at FNB Stadium, Johannesburg, and the second will be in Cape Town at DHL Stadium, on 22 January 2025.

Read more about Calabash South Africa and #DiscoveryBank48hours pre-sale access.

Shopping is better on Miles Ð-Day

Miles Ð-Day is coming up next week. This month, remind your clients why shopping is better with Ðiscovery Miles.

On Mondays, we share Ðiscovery Miles tips and tricks on X. You can share these posts and encourage your clients to keep an eye out to learn more about how to earn and spend their Ðiscovery Miles. Plus, they could stand a chance to win exciting prizes.

Here's a few ways qualifying Discovery Bank clients with Vitality Money can get up to 15% off every day of the month when they spend their Ðiscovery Miles:

- Shop for everything they need at our online and in-store Ðiscovery Miles retail partners.

- Buy prepaid products and services in the Discovery Bank app.

- Get exciting rewards in the Vitality Mall.

Plus, on the 15th of every month, these clients can get from 10% to 30% off at our online and in-store Ðiscovery Miles retail partners. Tell your clients to set their alarms for Monday, 15 April, when we will double their Ðiscovery Miles discount.

Share our Miles Ð-Day content on Social 360. Clients can also read our latest news article to find out more. Terms and conditions apply.

Enhancing the travel insurance experience

We recognise the need for quick and easy one stop solutions. So, from 1 May 2024, Discovery Bank Black and Purple accountholders will enjoy free international travel insurance through Discovery Travel Insurance, underwritten by Discovery Insure Ltd.

Discovery Travel Insurance will activate cover when clients buy international travel tickets in South Africa using their Discovery Bank card and will automatically send them their policy documents. Clients using Ðiscovery Miles to buy international travel tickets must contact Discovery Travel Insurance for their policy documents. Find more information.

Clients buying international travel tickets before 1 May 2024 using their Discovery Bank Black or Purple credit or debit card will still be covered by Visa (through Chubb Insurance South Africa) regardless of travel dates. They must contact Visa for claims. Those who've already travelled internationally and reported a claim to Visa must complete the claims process with them.

For help with:

- Visa:

- Claims: creditcardclaims@broadspire.eu

- Emergency claims: +44 (0) 208 762 8373

- Access policy documents: cardholderbenefitsonline.com

- Discovery Travel Insurance:

- Service: 0860 87 82 33 or travel.service@discovery.co.za

- Claims: 0860 87 82 33 or travel.claims@discovery.co.za

- Access policy documents: cardholderbenefitsonline.com

Emergency claims: 0860 87 82 33 or 011 292 8701 while outside South Africa.

New research: SpendTrend24 explores consumer spending insights worldwide

Visa and Discovery Bank have collaborated once more to compile SpendTrend24 - original research that analyses consumer spending in South Africa's three largest cities with that in 11 other global cities.

The expansive study combines Visa and Discovery's extensive datasets and world-class analytical capabilities to glean insights from over 60 million credit cards worldwide, unpacking spend behaviours, emerging trends, and the evolving expectations of consumers.

Insights include what people spend on, how much they spend, and how they spend - highlighting, for example, the growth in online and digital transformation, which has opened opportunities for economic growth and financial inclusion, as well as South Africa's surprising economic resilience.

Despite the financial challenges consumers are facing, this data-driven analysis can help you compare the spending patterns of typical South Africans and Discovery Bank clients with those of other emerging and developed markets.

In so doing, you can gain a clearer understanding of emerging global trends and opportunities, engage in more informed, relevant conversations with your clients, and expertly address their diverse needs and enhance their experiences.

Find a detailed breakdown of SpendTrend24 findings, insights, and expert predictions for 2024 here. You'll also be able to access and download the full report and infographics.

Clients can make the most of tax-free savings

Remind your clients to get a head start on their tax-free savings this tax year.

With a Discovery Bank Tax-Free Demand Savings Account, they can save up to R36,000 with zero monthly fees while earning 8% interest. Any amount not saved, up to the annual limit of R36,000 is forfeited and will not roll over to the next tax year.

Perfect for long-term savings, clients can open a Tax-Free Demand Savings Account in under 5 minutes!

Clients can save up to a lifetime limit of R500,000 so encourage them to start their tax-free savings journey now to benefit from compound interest. Learn more.

March 2024

Special offer: 25% boost on all adviser credit card referral fees for Q4

As a special offer, face-to-face advisers will automatically earn a 25% boost on all Credit Card Accounts and Suites sold between 15 March 2024 and 25 June 2024. That means you'll earn between R1,375 for a Gold Credit Card Account and R3,750 for a Black or Purple Suite (excluding VAT).

| Product | Normal fee (excl. VAT) | +25% campaign boost |

|---|---|---|

| Gold Credit Card Account | R1 100 | R1 375 |

| Platinum Credit Card Account | R1 650 | R2 063 |

| Black Credit Card Account | R2 200 | R2 750 |

| Gold Suite | R1 500 | R1 875 |

| Platinum Suite | R2 100 | R2 625 |

| Black / Purple Suite | R3 000 | R3 750 |

Special offer terms and conditions:

- The 25% campaign boost applies only on sales made by face-to-face advisers and referrals to the GrowthHouse Bank Referral Desk. Call centres are excluded from this special offer.

- Boosted referral fees apply to new sales made through the Financial Adviser Platform and GrowthHouse Bank Referral Desk. Standard GrowthHouse Bank Referral Desk referral fee splits apply.

- Boosted referral fees will also apply to any upgrades to Credit Card Accounts or Suites made by clients through their own Discovery Bank app, subject to standard upgrade payment timing rules (i.e. within six months of appointment date).

- Referral fee calculation is based on account opening date, and not sale start date.

- Standard referral fees apply on all other Discovery Bank products sold during this time.

- The 25% referral fee boost will be automatically included in referral fee payments and reflected in daily sales reports. However, for advisers on the engaged remuneration structure, the 25% referral fee boost will only be applied at the end of the campaign period.

Get immediate access to revolving credit

Your Discovery Bank clients can unlock financial flexibility with our Revolving Credit Facility, offering credit limits starting from R20,000 to R500,000. For those in need of additional financial support, clients have the opportunity to qualify for an extended credit limit of up to R1,000,000 based on approval.

Your Discovery Bank clients can enjoy:

- Immediate access to credit when they need it. Clients can simply transfer funds from their facility to their Discovery Bank credit card or transaction account in seconds

- Affordable repayments from as little as 2.5% of the outstanding balance

- Only paying fees when they use their facility

- Flexible repayment terms

- A lower interest rate by up to 7% with Vitality Money

Your clients can apply for revolving credit in under five minutes on their bank app:

- Log in to their banking app.

- Tap More on the home screen.

- Tap Credit Facilities.

- Tap Apply today on the Revolving Credit Facility tile and follow the steps to submit their application.

Whether it's for home improvements, last minute getaways or unexpected expenses, our Revolving Credit Facility provides your clients with unmatched flexibility and accessibility.

Access Social 360 to share our Revolving Credit Facility content with your clients. Read more about the Revolving Credit Facility.

Win: Vitality Travel local flights giveaway

Ahead of the public holidays, long weekends and school holidays this month, your clients can plan a local getaway and get up to 75% off their flights with all the local airlines in South Africa through Vitality Travel. That includes:

- Airlink

- CemAir

- FlySafair

- LIFT

- SAA

Plus, each airline will be giving away two return flights each, and your clients could stand the chance to win big!

The competition kicked off on Friday, 8 March and will run until Sunday, 31 March 2024 on the Discovery and Vitality social media channels.

Five lucky clients could each stand a chance to win return flight tickets for two people at a Vitality Travel local airline partner. To enter the prize draw, clients must comment on the giveaway post with their answers to the competition question. They can earn one entry for each comment on the relevant post.

Access Social 360 to share our competition content with your clients. Share the competition post and encourage your clients to enter the competition on Discovery South Africa's Facebook and X pages and on Discovery Vitality's Facebook, X and Instagram pages.

Toptier talent expected for Calabash SA 2025!

Calabash South Africa is back with Green Day, The Offspring, and Fokofpolisiekar performing in Cape Town and Johannesburg in 2025.

Discovery Bank Transaction Account, Credit Card Account, Suite, Ðiscovery Account, and Discovery Card clients get #DiscoveryBank48hours pre sale access to Calabash South Africa tickets.

The pre-sale opened on 13 March 2024 on the ticketmaster.co.za website with each client able to buy up to ten tickets per venue.

The first event takes place on 19 January 2025 in Johannesburg at the FNB Stadium, and the follow-up festival will be at the DHL Stadium, Cape Town on 23 January 2025.

Clients can visit ticketmaster.co.za now to book up to ten tickets per venue.

- Register or log in to their Ticketmaster profile

- Select Find tickets next to the Discovery Bank pre sale event link

- Pay with their Discovery Bank card or Discovery Card at checkout.

Read more about Calabash South Africa 2025 and #DiscoveryBank48hours presale access.

Pay less for March must haves on Miles Ð-Day

It's Miles Ð-Day today and you can help your clients get ready for the upcoming public holidays, long weekends and school holidays with fantastic discounts!

Qualifying Discovery Bank clients with Vitality Money can get up to 15% off every day of the month when they spend their Ðiscovery Miles in the Vitality Mall, on prepaid products and services in the Discovery Bank App, and at our Ðiscovery Miles retail partners.

Plus, Discovery Bank will double their Ðiscovery Miles discount on Miles Ð-Day on the 15th of every month. Encourage your clients to shop with their Ðiscovery Miles today and they can get up to 30% off at over 40 online and in-store Ðiscovery Miles retail partners.

Please share our latest news article with your clients and encourage them to keep an eye on our Facebook, X and Instagram pages for more information.

Kool & the Gang and Cigarettes After Sex live

Discovery Bank Transaction, Credit Card, Ðiscovery Account, Suite and Discovery Card clients get #DiscoveryBank48hours pre-sale access to tickets to the Kool & the Gang and Earth, Wind & Fire Experience by Al McKay 2024 tour and Cigarettes After Sex's X's World Tour.

Multiple award winning and Grammy nominated Kool & the Gang will perform on 28 November 2024 at GrandWest in Cape Town and on 30 November 2024 at Time Square in Pretoria. Cigarettes After Sex tours to South Africa for performances on 5 March 2025 at Time Square in Pretoria and on 7 March 2025 at GrandWest in Cape Town.

The ticket pre-sale opened on 6 March 2024 on ticketmaster.co.za. Clients can buy up to 8 tickets for each Kool & the Gang concert and each Cigarettes After Sex tour.

All they need to do is:

- Register or log in to their Ticketmaster profile

- Select Find tickets next to the Discovery Bank pre-sale event link

- Pay with their Discovery Bank card or Discovery Card at checkout.

Read more about Kool & the Gang, Cigarettes After Sex and #DiscoveryBank48hours pre-sale access.

February 2024

Automated competitor statement retrieval

We're streamlining credit applications with automated competitor statement retrieval. One of the most important steps in a credit application is the verification of a client's proof of income documents. When a client has their income deposited into an existing bank account at a supported bank, the Financial Adviser Platform allows advisers to capture the client's external account details to automatically retrieve their last three months' digital bank statements on their behalf - no manual submission required!

From end February 2024, automatic statement retrieval will become mandatory for collection of bank statements for any clients currently banking with Absa, Nedbank, and Standard Bank. Clients who have an account with a non-supported bank (eg. Capitec, FNB or Investec) will continue to manually provide you with their supporting documents, as these banks are not members of the Document Exchange Association.

When capturing credit applications on the Financial Adviser Platform, clients who bank with a supported bank will have to provide you with their external account number and account type rather than provide you with manual bank account statements. This enhancement is significantly more convenient for both clients and advisers, improves application completion rates, and reduces document submission errors.

Take That is coming to SA!

British pop phenomenon Take That has announced their tour to South Africa in October 2024!

The first performance will take place on 22 October 2024 in Cape Town at the Grand Arena in GrandWest, and the follow-up show will be at the SunBet Arena in Time Square, Pretoria, on 20 October 2024.

Clients can visit ticketmaster.co.za now to book up to eight tickets per venue. All they need to do is:

- Register or log in to their Ticketmaster profile

- Select Find tickets next to the Discovery Bank pre-sale event link

- Pay with their Discovery Bank card or Discovery Card at checkout.

The pre-sale opened on 28 February 2024. Read more about Take That.

Important Vitality Travel updates

From 1 March 2024, Vitality health assessments will become the cornerstone of Vitality Health benefits. Clients with Vitality Health will now only earn a maximum flight discount of 25% when they complete a Vitality Health Check and an online Vitality Age assessment. Clients with a qualifying Discovery Bank account can continue to boost their flight discount to up to 75% by engaging with the Vitality Money programme. The Vitality Money discount depends on the client's qualifying Discovery Bank product, card colour, Vitality Money status and monthly spend.

With this update, each adult on a Vitality Health policy must complete their own Vitality health assessments once every 12 months to earn the maximum Vitality Health flight discount. Adult dependants can boost their flight saving by opening their own qualifying Discovery Bank product and engaging with Vitality Money.

Children under the age of 18 will get up to 25% off flight bookings based on the maximum Vitality Health discount of the primary member on the policy. They do not qualify for Vitality Money rewards.

Please read and explain these important Vitality Travel updates to your clients.

Clients must make the most of tax-free savings

Tick tock... time's running out. Your clients have until 29 February 2024 to take advantage of the benefits of a Tax-Free Savings Account. It means they can save up to R36,000 a year tax free with no monthly fees while their savings can grow by up to 8% in interest.

The annual tax-free saving threshold is R36,000 and anything your clients save below this will not roll over to the next tax year. Assist your clients to check their annual savings thresholds so they don't have to pay tax penalties or lose out on the maximum perks of tax free savings.

It's Miles Ð-Day! Share the love

It's Miles Ð-Day today and your clients can get from 10% to 30% off on gifts and spoils for themselves and their loves ones.

Qualifying Discovery Bank clients with Vitality Money can get up to 15% off every day of the month when they spend their Ðiscovery Miles in the Vitality Mall, on prepaid products and services in the Discovery Bank, and at our Ðiscovery Miles retail partners.

Plus, they get up to 30% off when they spend their Ðiscovery Miles at over 40 online and in-store retail partners on Miles Ð-Day on the 15th of every month.