Goals: Keeping you focused on financial success

Research shows goals help to drive success in various areas of life such as your career and your health. When it comes to your financial future, goals are non-negotiable. Setting realistic goals and staying focused on them means you have the best possible shot at saving and investing successfully.

However, Warren Ingram, executive director at Galileo Capital, says that long-term financial planning is inherently difficult: “If you’re 25 and you set a goal to retire at age 55, that is so far in the future relative to where you are that the concept is almost academic.”

“That’s why so few people take their saving and retirement planning seriously”, he believes.

The goals are so far away that they’re simply “not realistic”.

Keep it SMART

The question then is how to make financial goals realistic. That’s where the well-known SMART system for (general) goal-setting is useful. The acronym suggests that every goal or objective should aim to be:

- Specific – not ambiguous or vague, rather state exactly what is required

- Measurable – necessary to quantify progress to achieve it

- Achievable – not extreme, but something realistic

- Relevant – goals that matter and

- Time-bound – set a goal within a defined time frame.

This system applies to all goals, but being “SMART” is crucial to achieve financial goals. An example of a SMART financial goal would be: “By 2021 I want to have saved R100 000 to put towards a deposit on a second property worth R800 000 in the Douglasdale area.”

Short-term steps

Ingram also advises investors to create short-term goals that are realistic, in order to reach their long-term goal. He likens these to waypoints on a long journey: “Without these, after a while you won’t even know what direction to go.”

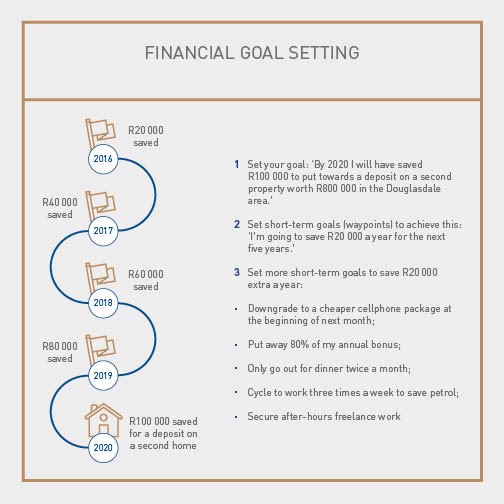

Take the SMART goal: “By 2021 I want to have saved R100 000 to put towards a deposit on a second property worth R800 000 in the Douglasdale area.”

In order to achieve this, you decide that your short-term goals (or “waypoints”) are to save an extra R20 000 for the next five years. You then narrow it down and write down more goals to indicate how you plan to save an extra R20 000 every year.

Breaking up a barely comprehendible time horizon into chunks also means your plan won’t be too complicated.

Ingram does not believe it is possible to have too many goals. Nor is it possible to plan too far ahead – if you’ve broken down your goals down into attainable objectives.

“A goal would be just the way you budget every month, for example,” he says. “Or a goal would be to save every month. Having these allows you to measure better towards your bigger goal.”

Review progress

These waypoints help you to review your progress far more easily, and also provide helpful context when looking back over a few months, or even years. Ask yourself: How am I measuring up against that?’

Being able to track your progress regularly means you can also catch any issue quickly says Ingram. “It’s difficult to make a year’s worth of saving up in month 11, if you only notice it then!”

But setting goals can be difficult. Not everyone can whip up a spreadsheet in a few hours that has structured, attainable financial goals for the next five years.

Whether or not you need the help of a professional financial adviser to help set goals is “dependent on the type of person,” says Ingram. In a room of 100 people, 33 of them would probably be able to do this on their own, he says. A further 33 would have no idea of what to do, and the group in between would probably be able to figure out a rough plan, but would need some help.

Adapt where necessary

Of course, all financial goals need flexibility because life is unpredictable. A marriage or partnership is one of the key events that can be a reason for some goal adjustment because different (and sometimes conflicting) needs and wants come into play.

Ingram believes that any partnership should have common goals that both people work towards. But this doesn’t mean “that there can’t be independence between the two,” he adds. Common goals mean agreeing on a path, agreeing how much you are going to spend and how much you are going to save.

But when you’re faced with any fork in the road, you will have to make a decision about whether or not you need to adjust your goals, says Ingram. “There will be various factors that will influence you”. The bottom line is that you should always keep your eye on the long-term financial goals, and adjust your short-term steps for getting there if necessary.

Discovery Invest is an authorised financial services provider. Registration number 2007/005969/07. For more information on Discovery Invest, contact your financial adviser. This material is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell investment funds.

Click here to share the article with your employees