Retirement products: What you need to know

The concept of retirement has certainly evolved over the last few decades. Thanks to extended life expectancy and a changing idea of what being “old” entails, most people don’t see themselves quietly sitting on a park bench and feeding birds during retirement.

Instead, modern retirement is increasingly seen as an opportunity to explore, start new ventures, become actively involved in your passions and, quite possibly continue making good money while doing so.

But despite this, it is still necessary to save for an income when you’re not working full-time.

Warren Ingram, the director at Galileo Capital, sums up the intention of retirement saving in a modern world: “The goal is to obtain financial freedom as quickly as you possibly can. Nowadays, achieving this goal means being able to work on things you really love, doing the things you want to do…”

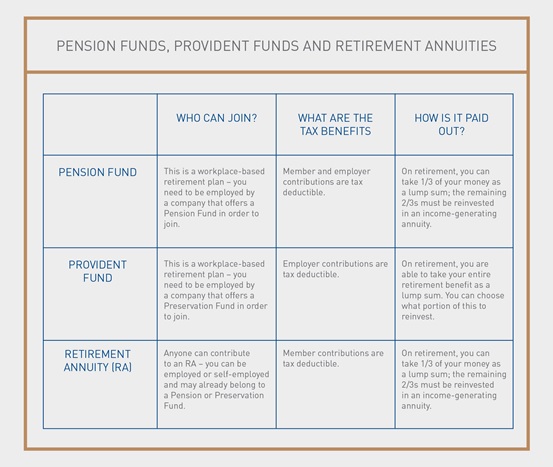

The easiest way of saving for retirement is through vehicles expressly designed for this purpose. The three most common investment vehicles are pension funds, provident funds and retirement annuities.

The most important aim of these savings vehicles is to encourage and enforce regular contributions towards a retirement income that will be accessed at retirement age. (It’s important to note that any lump sums paid out via pensions funds, provident funds and retirement annuities are taxable.)

More on retirement annuities

Firstly, anyone can buy a retirement annuity. You may be employed by a company, or self-employed. There are a number of factors that make retirement annuities appealing for those who want to save for retirement:

- According to Ingram, the tax benefits you receive with retirement annuities are enormous. While you can currently claim a tax deduction of 15% of non-retirement funding taxable income, this limit may be raised to 27.5% in either 2016 or 2017 as part of the retirement reform process being led by National Treasury.

- The flexibility inherent in retirement annuities has been one of the drivers of their popularity in recent years. You can change your contribution amounts over time, while pension or provident fund contributions are often based on a fixed percentage.

- With most retirement annuities you are able to choose the underlying asset classes that your money is invested in.

- Retirement annuities are also very effective estate planning tools. The proceeds are exempt from estate duty, capital gains tax and executor fees because the cash amount can be paid directly to beneficiaries if they exercise this option. However, the laws here are complex and you should seek professional advice first before using a retirement annuity for estate planning.

- Retirement annuities are also protected from creditors. (This does not apply to tax owed to the South African Revenue Service, maintenance claims and Section 37D claims like divorce.)

Where do you invest your money once you retire?

So you’ve reached retirement age and have received a payout from either a pension fund or a retirement annuity. What now? You’ll need to invest two-thirds of your investment in income-generating annuities.

Guaranteed annuity funds

With guaranteed annuity funds – also referred to as “traditional” or “life” annuities – your money is invested and your will be guaranteed a regular income for a defined period (Discovery’s Fixed Retirement Income Plan an example of this kind of annuity). Ingram notes that this regular income is typically adjusted for inflation over time. Some guaranteed annuities provide income escalations with profits.

Living annuity funds

Also described as a type of “personal pension plan”, the income that is generated from a living annuity is not guaranteed, but relies on the performance of the funds that the capital is invested in. (Discovery’s Linked Retirement Income Plan is an example of this kind of annuity fund.)

Investors will invest the two-thirds portion they receive from their pension or retirement annuity, or the portion they’ve decided to invest from their provident fund, in this living annuity. You will be able to choose how much money to take as an income, based on a predetermined minimum and maximum amount.

Ingram says that savers are able to withdraw annual income of between 2.5% and 17.5% of the residual capital each year. These are legislated limits. However, the Association for Savings and Investment South Africa (ASISA), has produced guidelines that require its members to inform investors about the knock-on effects of withdrawing too much or setting the income level too high. If investors make the wrong choices, especially early on, they may find that their annuity is used up too early.

The research that informed ASISA’s guidelines suggests that in most cases it is not advisable for investors to withdraw more than 5% of the value of the residual capital annually, if a pension is to be sustainable.

Switching jobs before you retire

If you have been contributing to a pension or provident fund, but decide to leave your employer and need somewhere to keep those savings safe until you retire, you can use a preservation fund. While it may be tempting to view a payout as an unexpected cash bonus, putting your money in a preservation fund is the wiser long-term option in building a retirement nest egg.

You are allowed to make one lump-sum withdrawal from a preservation fund before retirement. This might be taxed, depending on the value of the withdrawal.

How you access your preservation money upon retirement will depend on whether you have invested in a preservation pension fund or a preservation provident fund. (Note that new tax laws coming into effect from 2016 and 2017 will change these rules, although people who joined a provident preserver before 1 March 2016 will stay under the old system.)

- With a preservation pension fund you are entitled to take up to a third of your preservation fund money. The remaining two-thirds must be reinvested into an income-generating product such as a guaranteed or living annuity.

- With a preservation provident fund you are entitled to take the entire lump sum, and you’ll be taxed according to the value of the portion you receive.

Sources: http://www.financialplanningsouthafrica.com; www.fanews.co.za, sars.gov.za; http://youve-earned-it.co.za/; www.10x.co.za

For more information on investing for retirement, speak to your financial adviser.

This article is part of an investment series by Discovery Invest.

Discovery Invest is an authorised financial services provider. Registration number 2007/005969/07. For more information on Discovery Invest, contact your financial adviser.

This material is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell investment funds.

Invest

Because people have different goals, they need to invest differently. Discovery Invest offers a choice of investments, each one able to be tailored to...

Invest today